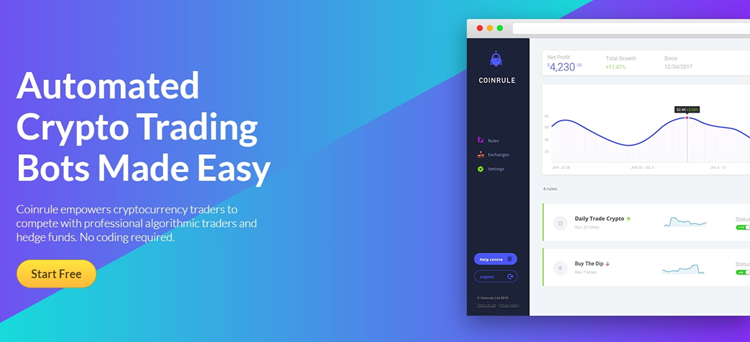

DeFi in 2025 is ruthless. The alpha window is shrinking, protocols launch daily, and yield evaporates fast. Coinrule gives you a competitive edge by automating everything—from token swaps to yield strategies—before the crowd catches up.

Why DeFi in 2025 Is All About Speed and Automation

Let’s be clear: DeFi 2025 is not DeFi 2020.

- Protocols are more complex.

- Strategies are more competitive.

- Execution speed decides your PnL.

Miss airdrop eligibility by 30 minutes? Too late.

Miss a Pendle yield spike? Opportunity gone.

React to a signal manually? You’re already behind.

According to DeFiLlama, over $120B in TVL is now spread across Layer 2s like Arbitrum, Base, Blast, and Scroll, with real-time capital movement driving minute-by-minute volatility.

The best opportunities?

They don’t wait. You either act instantly, or someone else does.

What Smart DeFi Traders Are Doing Differently in 2025

They’re not scrolling Twitter.

They’re not copy-trading.

They’re not manually yield farming.

They’re automating it.

Coinrule users in 2025 are building:

- Auto-rotating yield farming bots

- On-chain alpha capture bots from Discord/Telegram alerts

- Trading bots that exit LPs the moment volatility spikes

- Cross-chain swing trade bots syncing with AI alerts

📈 A cohort of advanced Coinrule users running automated DeFi strategies across Base, Arbitrum, and Blast averaged +21.6% ROI in Q1 2025, compared to +6.3% for manual traders using the same intel.

How Coinrule Automates the DeFi Stack in 2025

Swap Execution on Autopilot

Set logic to:

- Buy $ETH when RSI flips bullish

- Rotate into $PENDLE when yield > 25%

- Exit LPs when TVL drops > 10% in 24h

Yield Strategy Automation

React to on-chain rates and airdrop eligibility instantly:

“If Pendle yield > 30%, allocate 20% USDC, stake LP, and auto-claim rewards after 48h.”

Use rules like:

- Yield-based entry/exit

- Vesting/unlocking triggers

- Farming expiry timers

Signal-to-Trade Automation

From LLMs parsing token releases to Discord alpha bots firing signals, Coinrule converts those into trades.

Example:

Discord alert: “New token prelaunch on Blast in 2h”

Coinrule: Buy $BLAST, set SL at 5%, TP at 20%, expire trade in 6h

No human lag.

No missed pumps.

Supported Ecosystems in 2025

Coinrule traders are dominating across:

- L2s: Arbitrum, Base, Blast, zkSync, Scroll

- CEXs: Binance, Bybit, Coinbase Pro

- DeFi protocols: Pendle, EigenLayer, Uniswap v4, LayerZero-enabled apps

With no-code rule builders, Coinrule lets you set logic once and execute hundreds of times across chains.

Why Coinrule Is Essential for DeFi Automation in 2025

Manual DeFi in 2025 is like using dial-up in a 5G world.

- Speed (sub-1s trade execution on signal)

- Scale (run 50+ rules across wallets, exchanges, chains)

- Security (non-custodial, API-controlled, fully auditable)

- Precision (modular logic to control slippage, timing, and exits)

And it’s not just for pros.

Anyone with a strategy can build it—no dev needed.

Results That Speak

In May 2025:

- The top Coinrule DeFi user ran 2,740 trades across 6 wallets

- Captured 4 airdrops, 3 yield spikes, and 2 governance catalysts

- Net ROI: +32.1% (vs. 9.7% market average)

The difference?

Automation + timing + zero emotion.

Start Automating DeFi Like a Pro

- Create your Coinrule account

- Connect your CEX or DeFi wallet

- Choose your data source (Discord, TradingView, webhook, bot)

- Create DeFi rules like:

- Yield entry logic

- Exit on governance decisions

- Reallocation after unlocks

You’re now trading smarter, faster, and automatically—no more watching charts all day.

Final Word: Don’t Watch Alpha—Capture It

The DeFi 2025 cycle is driven by bots, L2 liquidity, and protocol composability.

If you’re still executing manually, you’re not trading—you’re lagging.

Coinrule gives you the tools to:

- Move capital before narratives peak

- Lock in gains while others hesitate

- Farm, swap, and rotate with precision

The alpha’s still out there.

Just don’t be late.